Recently, the much-anticipated acquisition case of Cypress semiconductor by Infineon was reviewed by the State Administration for Market Regulation of the People’s Republic of China and approved with additional restrictive conditions. The acquisition is expected to be completed around April 16. The transaction price of 9 billion euros also makes it the largest purchase in the semiconductor industry in 2019.

On August 8, 2019, the State Administration for Market Regulation received an undertaking concentration anti-monopoly declaration in the case of Infineon's acquisition of Cypress equity. On October 9, 2019, after collecting the supplementary declaration materials, the State Administration for Market Regulation placed the case on file and started the preliminary review, and implemented a further review on November 7 of the same year. On February 5, 2020, with the consent of the declarant, the period for further review was extended. According to the provisions of Article 27 of the Anti-Monopoly Law, the State Administration for Market Regulation has thoroughly analyzed the impact of concentration of undertakings on market competition and believed that this concentration has or may have the effect of eliminating or restricting competition in the global MCU market.

By soliciting opinions from relevant government departments, industry associations, competitors in the same industry and downstream customers, the State Administration for Market Regulation has successively understood relevant market definitions and market participants in the review process and verified the authenticity, completeness and accuracy of the documents and materials submitted by the declarant.

According to The Provisions on Additional Restrictive Conditions for the Concentration of Business Operators (for Trial Implementation), the State Administration for Market Regulation mainly evaluates the effectiveness, feasibility and timeliness of the restrictive conditions on the promises of restrictive conditions submitted by the applicant. The restrictive conditional commitment plan provided by the notifying party on March 27, 2020, can reduce the adverse impact of this concentration of operators on competition and require Infineon, Cypress and post-concentration entities to fulfill relevant obligations. If failed, they will be handled in accordance with the relevant provisions of the Anti-Monopoly Law.

It is reported that the restrictive conditions are valid for five years from the date of the decision announcement and will automatically terminate after the five-year period expires.

Alliance between giants

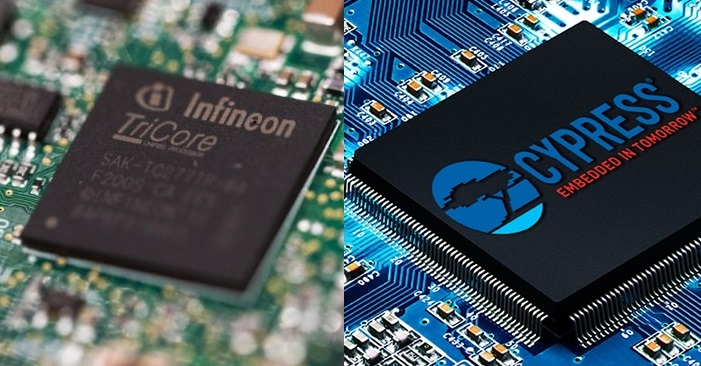

Why Infineon, Europe's largest chip maker, values Cypress? Prior to this, Infineon had stated that the two sides were highly complementary in terms of technology. In fact, Cypress has strong complementarities in the IoT, industrial and automotive fields with Infineon. The strong alliance between the two parties, together with certain restrictive conditions, can not only solve the adverse consequences of the concentration of operators that hinder competition, but also realize the benefits of concentration, which will further enhance market control.

Connection between real and digital world

In the future intelligent era, there will be hundreds of billions of devices interconnected, of which the demand for intelligence and connectivity is increasing day by day. "With this transaction, we will be able to offer our customers the most comprehensive portfolio for linking the real with the digital world. This will open up additional growth potential in the automotive, industrial and Internet of Things sectors. This transaction also makes our business model even more resilient." Said Infineon CEO, Reinhard Ploss. The planned acquisition will undoubtedly become a landmark step in Infineon's strategic development.

Infineon is one of the world's leading semiconductor manufacturers, formerly the semiconductor division of the Siemens Group. According to consulting company data, Infineon ranks second in the automotive electronics field, with the automotive electronics business accounting for 43% of the company's largest revenue. In contrast, although Cypress is relatively small, it is the world ’s third-largest supplier of memory and micro-controllers, with outstanding performance in the field of automotive electronics. Products in its multiple sub-sectors all ranked first. It is undoubtedly complementary to Infineon, which takes automotive electronics as a key layout field.

According to Hassane El-Khoury, President and CEO of Cypress, “The Cypress team is excited to join forces with Infineon to capitalize on the multi-billion dollar opportunities from the massive rise in connectivity and computing requirements of the next technology waves. This announcement is not only a testament to the strength of our team in delivering industry-leading solutions worldwide, but also to what can be realized from uniting our two great companies. Jointly, we will enable more secure, seamless connections, and provide more complete hardware and software sets to strengthen our customers’ products and technologies in their end markets. In addition, the strong fit of our two companies will bring enhanced opportunities for our customers and employees.”

Worried about being blocked

In June last year, Infineon and Cypress announced that the two companies had signed a definitive agreement, under which Infineon will acquire Cypress for USD 23.85 per share in cash, with a total value of 9 billion euros, making this transaction the largest merger and acquisition in the semiconductor industry in 2019. Its significance is self-evident.

The two parties both have important positions in the chip supply chain in Europe, America and even the world. The merger of the two will change the global semiconductor landscape, and the business of both parties in the transaction accounts for more than 1/4 in China. Therefore, since the announcement of the acquisition agreement, this USD 8.7 billion value M & A case has also experienced many setbacks.

At that time, Infineon believed that by 2022, the expected economies of scale would create a cost synergy of 180 million euros per year. In addition, the complementary product portfolio of the two parties would provide more chip solutions, and the potential revenue synergy, in the long run, is expected to exceed 1.5 billion euros per year. Earlier, US media also reported that the United States Foreign Investment Commission (CFIUS) may block the acquisition because some officials believe it will pose a risk to "national security." And this is indeed a matter of concern for the two semiconductor companies.

Until early March 2020, both Infineon and Cypress announced that CFIUS had completed the review of Infineon’s acquisition of Cypress and believed that the transaction had no “national security” issues.